Impact Analysis of Microfinance on Women Empowerment: An Empirical Evidence

DOI:

https://doi.org/10.54060/a2zjournals.jase.93Keywords:

Poverty, Microfinance, Woman EmpowermentAbstract

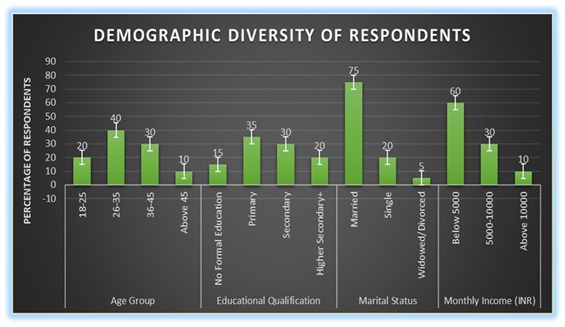

This study examines the impact of microfinance on women's empowerment in Rajasthan, emphasizing its role in their economic, social, and political engagement. The primary objective is to evaluate how Self-Help Groups (SHGs) contribute to improving women's access to financial resources, enhancing their decision-making abilities, and fostering socio-economic advancement. Additionally, the research seeks to analyze microfinance initiatives to determine their effectiveness in alleviating poverty, promoting gender equality, and enabling women to overcome systemic barriers. The study uses mixed methods between qualitative and quantitative methodologies. SHGs members from various rural and semi-urban locations in Rajasthan were nominated to participate in the structured interviews and surveys, which were then used to gather primary data. Secondary data, including eports and case studies, supplemented the analysis to contextualize findings within broader trends. Statistical tools were employed to measure the relationship between SHG participation and indicators of empowerment, such as income generation, access to education, healthcare decisions, and community involvement. The findings reveal that participation in SHGs significantly enhances women’s financial independence, improves household decision-making, and strengthens their confidence in public life. Microfinance serves as a catalyst for creating sustainable livelihoods, reducing dependency on exploitative lending practices, and fostering community solidarity. However, challenges such as limited literacy, lack of training, and socio-cultural constraints remain barriers to maximizing the benefits. The study emphasizes that sustaining the positive effects of microfinance on women's empowerment in Rajasthan requires well-designed policy measures, capacity-building initiatives, and ongoing support for Self-Help Groups (SHGs).These insights contribute to the growing evidence base on the transformative potential of microfinance in achieving inclusive development goals.

Downloads

References

N. Kabeer, “Resources, agency, achievements: Reflections on the measurement of women’s empowerment,” Dev. Change, vol. 30, no. 3, pp. 435–464, 1999.

A. Malhotra, S. R. Schuler, and C. Boender, Measuring Women’s Empowerment as a Variable in International Development. World Bank, 2002.

A. Simanowitz and A. Walker, Ensuring Impact: Reaching the Poorest while Building Fi-nancially Self-Sufficient Institutions, and Showing Improvement in the Lives of the Poorest Women and Their Families. Women’s Empowerment through Micro-finance, SIDA. 2002.

A. Sen, “Gender and Cooperative Conflicts,” in Persistent Inequalities, I. Tinker, Ed. Ox-ford University Press, 1990.

A. Sen, “Capability and well‐being,” in The Quality of Life, Oxford University Press, 1993, pp. 30–53.

H. Zaman, Assessing the Poverty and Vulnerability Impact of Micro-Credit in Bangladesh: A Case Study of BRAC. World Bank, 2001.

“Engendering development: through gender equality in rights, resources, and voice,” Choice (Middletown), vol. 39, no. 01, pp. 39-0422-39–0422, 2001.

“Microfinance and Gender: CGAP Gender Guide. Consultative Group to Assist the Poor,” CGAP, 2003.

L. Mayoux, “Women’s Empowerment through Sustainable Micro-finance: Rethinking ‘Best Practice,” ’ Development Bulle-tin, vol. 57, pp. 76–81, 2005.

R. B. Swain and F. Y. Wallentin, “Does microfinance empower women? Evidence from self‐help groups in India,” Int. Rev. Appl. Econ., vol. 23, no. 5, pp. 541–556, 2009.

M. M. Pitt and S. R. Khandker, “The impact of group‐based credit programs on poor households in Bangladesh: Does the gender of participants matter?,” J. Polit. Econ., vol. 106, no. 5, pp. 958–996, 1998.

S. Cheston and L. Kuhn, “Empowering Women through Microfinance,” UNIFEM, 2002.

S. M. Hashemi, S. R. Schuler, and A. P. Riley, “Rural Credit Programs and Women’s Em-powerment in Bangladesh,” World Development, vol. 24, no. 4, pp. 635–653, 1996.

F. Sinha, “Access, Use, and Contribution of Microfinance in India: Findings from a National Study,” Economic and Political Weekly, vol. 40, no. 17, pp. 1714–1719, 2005.

M. A. Chen, A Guide for Assessing the Impact of Microenterprise Services at the Individual Level. Washington, DC: AIMS, 1997

Downloads

Published

How to Cite

CITATION COUNT

Issue

Section

License

Copyright (c) 2025 Khushboo Sogani

This work is licensed under a Creative Commons Attribution 4.0 International License.