An Examination of Investors’ Perceptions Regarding Contemporary Investment Prospects in Rajasthan

DOI:

https://doi.org/10.54060/a2zjournals.jase.81Keywords:

Investment behavior, contemporary investment options, mutual funds, equity, investor perception, RajasthanAbstract

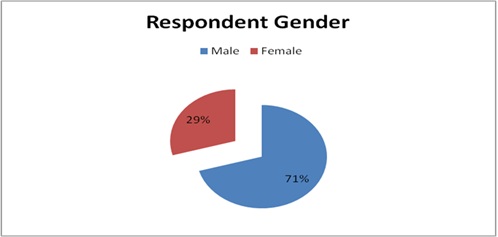

India's rapid economic growth has led to an expanding array of investment opportu-nities, attracting modern investors seeking diversification. This study examines in-vestor perceptions of contemporary investment options in the Didwana-Kuchaman District of Rajasthan. It explores how demographic factors influence investment deci-sions and evaluates preferences for instruments such as mutual funds, equities, sov-ereign gold bonds, REITs, ULIPs, small cases, cryptocurrency, and portfolio manage-ment services. The research, based on primary data from 145 respondents, reveals a preference for low-risk, long-term investments, with mutual funds and equities emerging as top choices. Findings suggest that income level, financial literacy, and past investment experiences significantly shape investor behavior. The study under-scores the importance of awareness initiatives to enhance decision-making and op-timize investment strategies.

Downloads

References

B. M. Barber and T. Odean, “The behavior of individual investors,” in Handbook of the Economics of Finance, Elsevier, 2013, pp. 1533–1570.

L. Ganapathi, “A study on awareness, attitude and investment decision of Government employees in Bangalore City,” International Journal of Business and Administration Research Review, vol. 3, pp. 114–119, 2015.

K. Gaurav, A. S. Ray, and A. Pradhan, “Investment Behavior of Corporate Professionals Towards Mutual Funds in In-dia,” International Journal of Accounting & Finance Review, vol. 14, no. 1, pp. 30–39, 2023.

R. Jayasatha, “A Study on Investors’ Investment Pattern in Various Avenues (Empirical study in Coimbatore city),” GJRA-Global Journal for Research Analysis, vol. 1, 2014.

A. Jhanwar and M. Agarwal, “REITs: Pioneering Investment Paradigm in India,” International Journal for Multidisciplinary Research (IJFMR), no. 6, 2022.

A. Jhanwar, “Smallcase: A new way of investing in india Inspira,” Inspira- Journal of Modern Management & Entrepre-neurship (JMME), vol. 14, no. 1, pp. 76–78, 2024.

S. Patil, Assistant Professor International Institute of Management Science Pune-411033, Maharashtra, India, and D. K. Nandawar, “‘A study on preferred investment avenues among salaried people with reference to Pune, India,’” IOSR J. Econ. Finance, vol. 5, no. 2, pp. 09–17, 2014.

N. S. Shukla, “Investors Preference towards Investment Avenues with Special Reference to Salaried Personnel in North Gujarat Region,” International Journal for Science and Research in Technology, vol. 2, no. 1, pp. 43–49, 2016.

Downloads

Published

How to Cite

CITATION COUNT

Issue

Section

License

Copyright (c) 2025 Anurag Jhanwar

This work is licensed under a Creative Commons Attribution 4.0 International License.