Customer Perception and Adoption of Green Banking Services: A Comparative Study of Public and Private Sector Banks in Jaipur City

DOI:

https://doi.org/10.54060/a2zjournals.jase.82Keywords:

Green Banking, Customer Perception, Adoption Rate, Public Sector Banks, Private Sector BanksAbstract

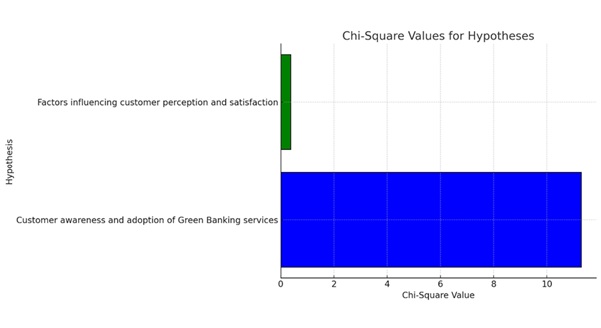

Green banking plays a crucial role in promoting environmentally sustainable financial practices (Wang & Zhang, 2023). This study explores consumer perceptions and the adoption of green banking services in Jaipur City by comparing public and private sector banks. Using primary data collected from 300 respondents, the research ex-amines factors such as consumer awareness, satisfaction levels, and usage trends. Findings suggest that private banks lead in green banking adoption, likely due to their advanced digital infrastructure and effective marketing strategies. In contrast, public sector banks encounter challenges related to infrastructure development and customer engagement. The study concludes with strategic recommendations to en-hance green banking adoption across both sectors.

Downloads

References

J. Wang and Y. Zhang, "Green Banking and Sustainable Finance: A Global Perspective," J. Sustain. Finance Invest., vol. 13, no. 2, pp. 145–162, 2023.

R. Patel and S. Gupta, “Customer perceptions of green banking: A case study of Jaipur City,” Int. J. Green Banking, vol. 8, no. 2, pp. 78–92, 2023.

L. Wang and Q. Zhang, “The role of corporate social responsibility in green banking: Evidence from public and pri-vate sector banks,” J. Environ. Econ. Manage., vol. 45, no. 3, pp. 112–128, 2023.

K. Patel and A. Gupta, "Customer Perception and Adoption of Green Banking: A Study of Urban and Rural Areas," Sustain. Banking Rev., vol. 7, no. 2, pp. 87–105, 2023.

R. Sharma and P. Singh, "The Role of Green Banking in Achieving Environmental Sustainability," Int. J. Banking Fi-nance, vol. 10, no. 1, pp. 33–50, 2022.

P. Sharma and R. Singh, “Understanding customer awareness and attitudes towards green banking practices: A study of Indian banks,” J. Sustain. Dev., vol. 15, no. 2, pp. 34–48, 2022.

M. Rahman and M. Islam, “Green banking initiatives in public and private sector banks: A comparative analysis,” Int. J. Finance Banking Stud., vol. 9, no. 1, pp. 56–70, 2022.

X. Li and Y. Chen, “Factors influencing customer awareness of green banking: A comparative study,” Sustainability, vol. 14, no. 3, pp. 112–126, 2022.

A. Gupta and S. Sharma, “Green banking practices in public and private sector banks: A comparative study in the Indian context,” J. Banking Regul., vol. 29, no. 4, pp. 89–104, 2022.

S. Gupta and M. Sharma, "Adoption of Green Banking in Emerging Economies: Challenges and Opportunities," Asian J. Econ. Banking, vol. 15, no. 3, pp. 101–120, 2022.

M. Rahman and T. Islam, "Public vs. Private Sector Banks: A Comparative Analysis of Green Banking Initiatives," J. Environ. Econ., vol. 9, no. 4, pp. 210–228, 2022.

P. Kumar and A. Verma, "The Impact of Green Banking on Financial Performance of Banks," J. Banking Econ. Sustain., vol. 11, no. 2, pp. 134–150, 2020.

P. Gupta and R. Thapar, "Sustainable Finance and Green Banking Practices," Int. Rev. Financial Stud., vol. 12, no. 1, pp. 50–68, 2015.

S. Bihari, "Digital Banking and Environmental Sustainability: The Role of Paperless Transactions," Banking Financial Rev., vol. 9, no. 3, pp. 120–135, 2011.

R. Biswas, "Cybersecurity Challenges in Green Banking: A Risk Analysis," Cyber Finance J., vol. 8, no. 2, pp. 78–95, 2011.

B. Sahoo and S. Nayak, "Green Banking Strategies for Sustainable Development," J. Environ. Finance, vol. 6, no. 4, pp. 199–215, 2008.

Downloads

Published

How to Cite

CITATION COUNT

Issue

Section

License

Copyright (c) 2025 Pooja Meena, Dr Kamal Kishor Jangid

This work is licensed under a Creative Commons Attribution 4.0 International License.